Financial planning: building up—and around—your retirement nest egg

Help reduce the stress of retirement with a well-rounded financial plan. Here's how to get started.

Does financial planning sound intimidating? It doesn’t have to be. Building a well-rounded strategy can start with simple questions about your goals and can give you confidence in your future. By understanding the key elements of a sound financial plan—with the help of a financial professional—you may be able to mold a more complete vision of the retirement you want to live.

What is financial planning?

Financial planning is a process for setting, tracking and achieving your financial goals over time. It involves evaluating your current financial situation, determining where you want to be in the future, and establishing a strategy for getting there. And when it comes to retirement, financial planning is an integral part of helping you live the life you want when your working days are done.

Financial planning first step: self-awareness

A powerful first step to any financial plan is knowing yourself. Setting money aside for the future can help you start building financial stability. But better understanding your goals for retirement—and potential roadblocks to getting there—will help clear your path toward retirement success.

- Cut the stress out of retirement. Take inventory with an interactive tool designed to give you insight into the impact that stress can have on your retirement.

- Pursue your next passion. Follow an interactive assessment and discover ways to connect your interests and hobbies to new activities in retirement.

- Prepare your financial plan. Learn how to avoid potential threats to your financial security and determine if your plan is ready to support the retirement you deserve.

What makes a well-rounded financial plan?

With clarity around what you want out of retirement, you can better strategize your path to getting there. Your financial professional can help you address these key areas to make your financial plan balanced and tailored to your retirement goals.

- Saving, investing, and generating income. Once you retire, covering your day-to-day expenses with savings becomes key. A steady income stream, like an annuity may be able to provide, can help bridge the gap between the savings you've accumulated over time and traditional sources of retirement income.

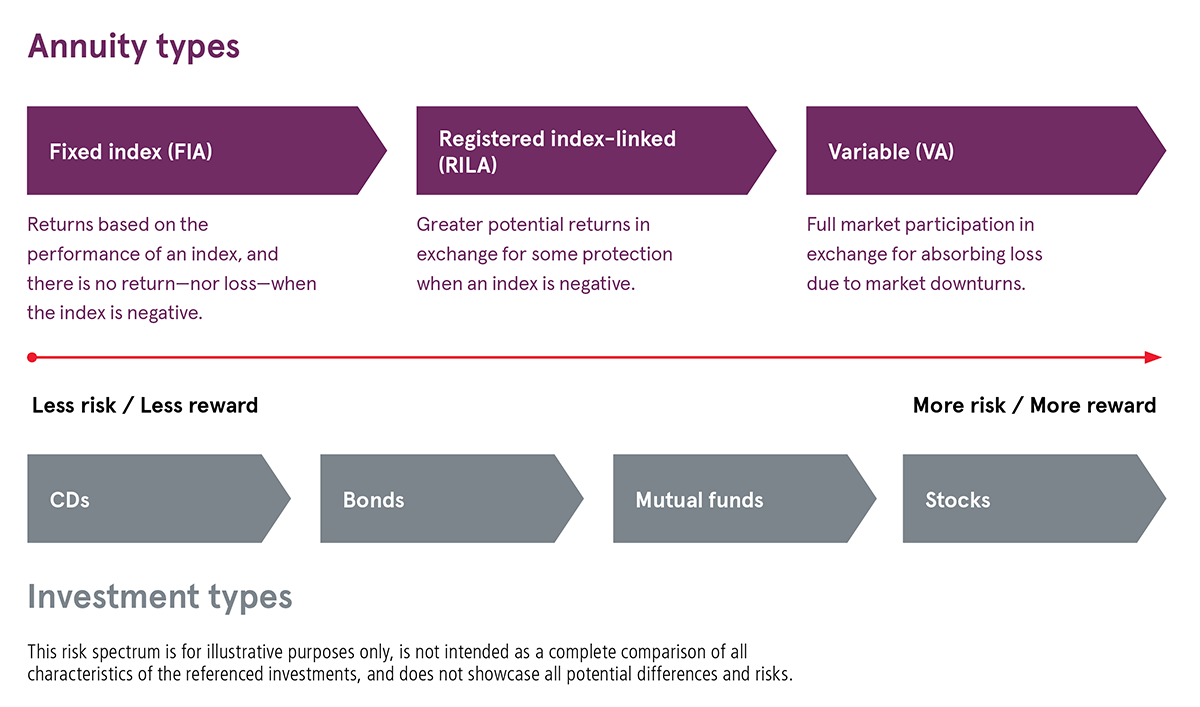

- Balancing protection and growth. Depending on your risk tolerance, asset growth is possible with many different types of annuities. Think of income protection and growth in the form of a risk spectrum—how much are you willing to expose yourself to potential market loss, and how much do you want to gain?

- Planning tax-efficiently. Saving on your tax bill may be important to you—particularly when drawing income and investing. Annuities can potentially help you grow your retirement assets while managing the impact of taxes.

Saving, investing, and generating income

An annuity is a retirement product that may provide reliable income when you need it. It can help bridge the gap between the savings you’ve accumulated over time and traditional sources of retirement income, like Social Security. Plus, if you don’t need the income immediately, you can let an annuity potentially grow tax deferred.* That’s why an annuity may be a powerful addition to your financial plan.

At Jackson, we have a variety of financial calculators and tools that can help clear up the financial planning process. With these tools, you can work with your financial professional to explore how much income you might need in retirement—and when. Then you can make a more informed decision about whether, and which, annuity products are a right fit for your plan.

- Retirement expense & income calculator. Our retirement expense & income calculator provides a way for you to work with a financial professional to effectively project expenses in retirement using factors such as current income, retirement age, and retirement state. You can also calculate the gap between essential expenses and guaranteed income to discover potential solutions.

- Social Security calculator. Social Security is a foundational part of a retirement income plan, and deciding when to start collecting monthly benefits is an important decision. Our Social Security calculator, powered by Envestnet MoneyGuide, is designed to help make your decision easier.

Balancing protection and growth

Annuities may potentially serve multiple purposes in your financial plan to help meet your unique retirement needs. As with any investment, annuities can be selected based on a balance between the risk and reward of the specific product.

To understand them better, let’s look at different types of annuities (along with various investment types) and how they’re commonly utilized in financial plans. EXPLORE THE BENEFITS OF ANNUITIES

Planning tax-efficiently

When it comes to financial planning, you likely want to keep more of your earnings invested toward your retirement. And that's one of the advantages of annuities. You can defer taxes on your interest and investment earnings until you take income from them.

That’s good news because this tax-deferral period can have a dramatic effect on the accumulation and withdrawal amounts of your investments. USE THIS CALCULATOR TO SEE HOW.

Talk to your financial professional about your retirement goals and how an annuity may support your financial plan for retirement.