Will your retirement income be enough?

Do you have enough retirement income to cover all of your expenses, or do you have a retirement income gap? Learn what factors can affect your retirement income and how to help close the gap.

What if your retirement savings isn't enough to cover your expenses?

Pensions and Social Security used to be the main sources of income for retirement. Now the responsibility lies with retirees, and your personal assets play a more significant role. If you don’t think you’ll have enough saved, you may need an additional source of guaranteed* retirement income to help—but how will you know?

Calculate your retirement expenses

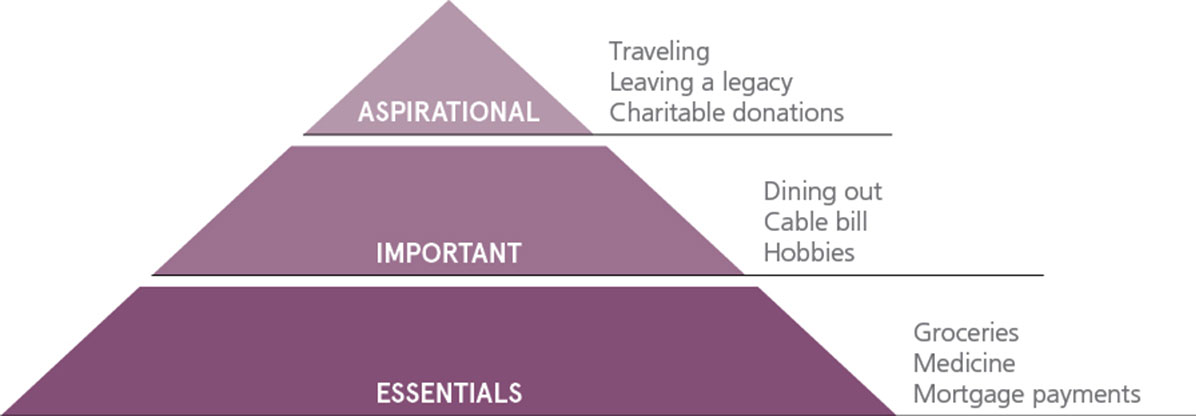

When planning for your future, think of your retirement income needs as a pyramid.

Write down your expenses within each level of the pyramid:

- The top: Aspirational expenses. Traveling, leaving a legacy, and charitable donations. These are the things you’d like to do but are more like the icing on a retirement cake.

- The middle layer: Important expenses. Dining out, cable bill/streaming services, and hobbies. They’re nice to have for your own comfort and lifestyle.

- The foundation: Essential expenses. Groceries, medicine, utilities, and mortgage payments. These make up the base of your pyramid because it’s the stuff you can’t live without.

Each of these layers is a key piece in your financial planning.

Now estimate the cost of every line item within each layer. Then add them up and calculate the total amount you would need to cover them each month.

Your retirement income

Once you’ve estimated what your expenses could be, calculate the retirement income you expect to have.

This could include distributions from investments, real estate income, annuity payments or even a part-time job. Will you have enough income to last through your whole retirement? This step will help determine if there’s a gap between what you’ll need and your expected available resources. If the amount of your expenses exceeds the amount you have coming in, you have a retirement income gap.

How do I close a retirement gap?

If you have an income gap, the good news is that there are plenty of income options available to help bridge it. You and your financial professional can discuss the various ways to do that, but here are some questions to ask yourself before digging into those choices:

- When do you plan to retire—now, soon, or later?

- Are you looking for guaranteed income to help support one or two people?

- Are you more focused on the cost of the investment products or the value of the guarantees they can provide?

- How often will you need income—monthly, quarterly, or yearly?

Other factors that can affect your retirement income

Unfortunately, it’s not as simple as money in and money out. There are several other factors to consider when looking at how long your money will last, such as:

Inflation: Over time, the cost of goods may rise. According to the U.S. Bureau of Labor Statistics, in December 2023 there was a 3.4% increase in the Consumer Price Index over the previous 12 months.1 You may want to plan for inflation in retirement because it can be a dream killer.

Longevity: It sounds like a great thing to live a long life—and it is—but living longer means you need your money to last longer.

Market volatility: When you’re ready to take a withdrawal from your retirement savings accounts, timing is everything. If you start when the market is down, you run the risk of having less income down the road. Though it’s impossible to predict what the markets will do, guaranteed income could address this concern.

Required minimum distributions (RMDs): This is the minimum amount you have to withdraw annually from your qualified retirement accounts—excluding Roth IRAs—and will be included in your taxable income. RMDs must begin by age 73† to avoid additional tax consequences. (This rule is in place to ensure that people don’t use a retirement account to avoid paying taxes.)

Taxes: You should also consider the timing of taxes on your distributions. Is it a qualified or nonqualified account? Are you in a lower tax bracket in retirement than you were in your working years? Do you have gains that will be taxed?

Could tax deferral potentially help your money last longer?

Maybe. We don’t have a crystal ball (and neither does your financial professional), but it’s possible that a tax-deferred‡ investment could allow your money to grow faster. How? Hypothetically, let’s say you want to invest $100,000 in a variable annuity with an add-on guaranteed income benefit. You aren’t taxed on that sum until you start taking withdrawals, allowing the full $100,000 to grow, rather than a lower initial investment that’s been reduced by taxes.

What is a variable annuity (VA)?

Variable annuities are long-term, tax-deferred investments designed for retirement. They involve investment risks and could lose value. Your earnings are taxable as ordinary income when distributed and you may be subject to a 10% additional tax for withdrawals you take before age 59½ unless an exception to the tax is met.

Add-on living benefits cost extra, in addition to the ongoing fees and expenses of the VA and have conditions and limitations. There’s no guarantee that a VA with an add-on living benefit will provide sufficient supplemental retirement income, but it may help. Is a VA with a living benefit right for you? Only you and your financial professional can answer that.

Be ready for the next chapter

Saving for retirement can be a multi-decade-long journey. As your income rises over the years, hopefully, the amount you’re saving and investing does, too. But if that’s still not enough to carry you through retirement, talk to your financial professional about protected income options.