Unearthing the risks of living by the 4% rule

The 4% rule was created as a guide for retirees to withdraw from their savings in retirement. Learn about the potential risks retirees may face living by this rule.

If you’ve been planning for retirement, you’ve likely heard of the 4% rule. Unveiled in 1994, financial advisor Bill Bengen created this practical rule of thumb as a guide for retirees on how to withdraw from their savings in retirement.

Understanding the 4% rule

Using historical stock returns and retirement data from 1929 to 1991, Bengen determined that retirees can safely withdraw 4% of their retirement balance, in a 50/50 stock and bond portfolio, to live on during their post-employment years—with annual readjustments for inflation. He concluded that the remaining retirement savings could last 30 years or more, even during difficult market conditions.1,2

If you think of your retirement savings like a garden, the 4% rule is a guide for how much you should harvest to ensure your remaining crops last a lifetime.

As with any theory or rule, there were criticisms for the inapplicability due to, for instance, different types of retirement portfolio investments, the inability to carry forward historical performance to future assumptions, and others. Despite its flaws, the 4% rule reigned supreme for the next 20 to 25 years. Then more risks began to show, causing some alarm.

Multiple studies and leading researchers have called the 4% rule into question.3 Many of the criticisms of the 4% rule revolve around facts and circumstances that are difficult to predict, such as market volatility and longevity, and on factors that were not considered in Bengen’s original analysis, such as taxes and investment management fees. Also of note, recent increases in fixed income returns have triggered a resurgence of the 4% rule amongst some commentators. However, recent studies purporting the virtues of the 4% rule still do not overcome previous criticisms.

Risk #1: market volatility

The economy is always changing. Inflation rates, global uncertainty, and demographic shifts have impacted the volatility of today’s market landscape. Bengen himself, who retired in 2013, said in recent years that the 4% rule no longer works given recent economic events causing market volatility.4

Bengen’s initial 4% rule study looked at rolling 30-year returns from 1929 to 1991. Without accounting for fees, investment costs, and taxes, 4% was an adequate withdrawal to account for market volatility. However, low returns on fixed income have a significant impact on the sustainability of a 4% withdrawal strategy. In a 2013 paper in the Journal of Financial Planning, Michael Finke, Ph.D., CFP; Wade Pfau, Ph.D., CFA; and David Blanchett, CFP, CFA argue that lower bond yields equate to decreased sustainability of a 4% inflation-adjusted withdrawal (recall that the 4% rule is based on a 50/50 stock and bond portfolio).5

While recent bond yields have increased, the long-term government bond yield in December of 2023 was 4.2%. From 1960 to 1991 the average bond yield was 7.63%, and the average yield from 1992 to 2023 was 4.0%.6

To this point, Wade Pfau, made the following assessment: “I think there is something like a 65% to 70% chance that the 4% rule works for today’s retirees rather than being a near certainty.” Pfau places the actual safe withdrawal rate closer to 3%.7

Risk #2: taxes

On top of economic volatility, the 4% rule fails to take into account taxes and fees on the actual amount that a retiree withdraws. For example, if you have $2 million in retirement savings, you can withdraw $80,000 from your account based on the 4% rule. But if you’re a single filer, and that’s your only source of income, you’d owe approximately $9,441 in federal taxes, which must be paid from the $80,000 withdrawal. So in reality, that $80,0008 is only worth $70,559 after taxes. That means you’d either have to withdraw more than 4% to account for taxation or survive on less than 4% each year in retirement.

Risk #3: investment management fees

Taxes aren’t the only cost on your withdrawals. Financial professionals and investment management fees, as well as any potential withdrawal fees, can add up too. And some financial professional fees have increased over the last few years.

Looking back at your $80,000 hypothetical withdrawal above, if you also have to account for a 1% advisory fee and other underlying investment fees between 0.5 to 1%, you may really only have approximately 1.5 to 2.1% of your savings in spendable income. To safely withdraw $80,000 in spendable income, you’d have to withdraw somewhere between 6.2 to 6.7% of your savings, far greater than what the 4% rule allows.‡

And if you’re worried about running out of money in retirement, withdrawing more than 6% from your savings every year may not alleviate your concerns.

Risk #4: portfolio allocation

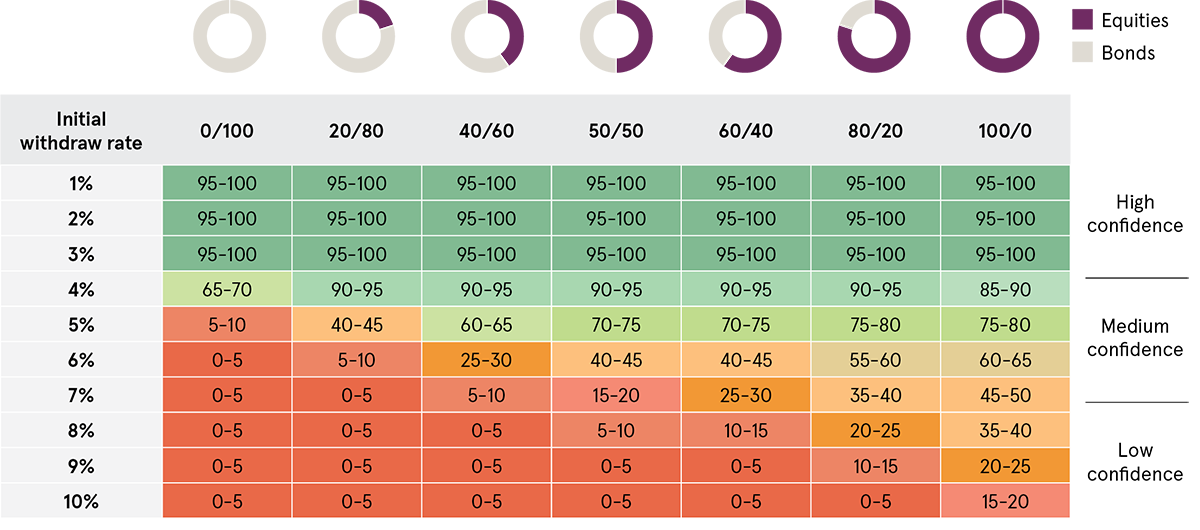

Finally, the success of the 4% rule also depends on where your money is invested. The graph below shows the “likelihood of success” that retirement accounts would be able to provide for the needs of accountholders over 30 years. For a bonds-only portfolio, an “initial withdrawal rate” of 4% has a confidence rating of only 65 to 70% compared to 85 to 90% confidence rating for an equities-only portfolio. However, a stock and bond portfolio containing 20% to 80% stocks and 80% to 20% bonds has a probability of success between 90 to 95%.

Note that 90 to 95% still does not guarantee that a 4% withdrawal for 30 years of retirement is sufficient to provide for a retiree’s needs, especially considering the additional factors above. You can see current researchers, like Wade Pfau have deviated closer to the 3% withdrawal rates—reflecting 95 to 100% probability of success, which may alleviate financial security concerns many retirees face.

Source: JP Morgan Asset Management, "Annuities improve outcomes," accessed December 6, 2023.

Accounting for risk: income for life

So, how can you confidently choose between the income you need to live on year after year in retirement and the nest egg you worked so hard to grow in your working years? Well, the answer is, you may not have to.

An annuity is a retirement product that may provide protected, reliable income when you need it. It may help bridge the gap between the savings you've accumulated over time and traditional sources of retirement income, like Social Security. Plus, if you don't need the income immediately, you can let an annuity potentially grow tax deferred.* That's why an annuity may be a powerful addition to your financial plan.

Annuities, specifically variable annuities with living benefit riders,§ can help provide for guaranteed income to ensure that retirement goals are met—and maybe even exceeded. Ask your financial professional how an annuity may support your long-term retirement goals.