For best printing results, use the Google Chrome browser. For all browsers, use the following settings whenever possible, some browsers may not have all settings available:

- Print in color, not black and white

- Turn off page headers and footers

- Turn on background graphics and colors

CMC22818CR 08/24

Monthly expenses in future dollars

Long description.

Structure.

Chart graphic.

Projected monthly expenses broken down by spending category

My monthly total in future dollars

Long description.

Structure.

Chart graphic.

Total monthly expenses across all spending categories

How will my expenses grow?

Long description.

Structure.

Chart graphic.

Monthly expenses inflated through end of plan age

My unique inflation rate

Long description.

Structure.

Chart graphic.

Impact of compounded inflation throughout retirement

Did you know?*

CMC22818CR 08/24

Monthly total and expenses to protect

Long description.

Structure.

Chart graphic.

Monthly total projected expenses are represented by the grey outer bar. Total expenses to protect are represented by the inner colored bars and reflect a percentage of future expenses that need to be covered by guaranteed sources of income.

Monthly guaranteed income

Long description.

Structure.

Chart graphic.

Monthly guaranteed income reflects your anticipated sources of monthly retirement income such as Social Security, pensions, and other guaranteed sources (e.g. annuities, rental income, etc.). Figures displayed represent future dollars.

with an add-on living benefit is one way you could fill your estimated income gap in retirement.

A variable annuity is a long-term, tax-deferred investment designed for retirement. The principal value of a variable annuity will fluctuate in value based on the performance of the underlying investments and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met.

The above assumptions have been used to determine the amount you could invest in a Variable Annuity with an add-on living benefit today to fill your income gap at retirement.

Add-on living benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity and may be subject to limitations or conditions. There is no guarantee that a variable annuity with an add-on living benefit will provide sufficient supplemental retirement income.

Allows you to focus on your personal goals, knowing that you'll receive guaranteed income for life.

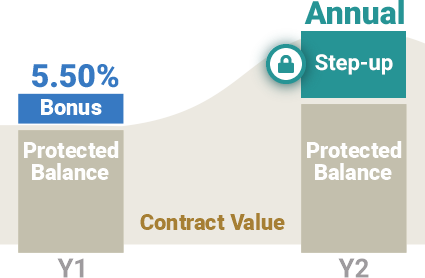

In a down or flat market, your guaranteed withdrawal balance grows by a certain percentage.

When the market is up, step-ups automatically lock in gains and grow your guaranteed withdrawal balance each contract anniversary.

Bonus percentage shown is for illustrative purposes only and is not representative of any specific product.

is a "stream of income" you can't outlive.Your guaranteed annual withdrawal amount (GAWA) is a percent of your guaranteed withdrawal balance. It is determined by your age at your first withdrawal and can increase with market step-ups and bonuses.

As an example of an income stream, your withdrawal amount percentage could be

{strong}5.00%{endStrong} at age {strong}65{endStrong}

You’ll receive your percentage each year for the rest of your life.

Guaranteed Annual Withdrawal Amount %

Long description.

Structure.

Chart graphic.

GAWA percentages shown are for illustrative purposes only and are not representative of any specific product.

Guarantees are backed by the claims paying ability of the issuing insurance company and do not apply to the principal amount or the performance of a variable annuity's underlying investments.

With some annuities, a return of premium death benefit will provide the greater of your contract value or the sum of all premium payments reduced for withdrawals.

The graphics shown are for illustrative purposes only and are not representative of any specific product.

Net Premium is equal to the total of all premium paid less withdrawals (including any applicable charges and adjustments for such withdrawals). Generally withdrawals will reduce the standard death benefit in the proportion that the contract value was reduced on the date of such withdrawal. If the contract value falls to zero, the standard death benefit is typically terminated.

Many variable annuities allow you to choose from prebuilt asset allocation models or allow you to customize your own portfolio.

When you purchase a variable annuity with an add-on benefit, you have the opportunity to receive monthly guaranteed withdrawals. It is one way you can fill your income gap for the rest of your life.

Retirement expense projections are for illustrative purposes only and results may vary with each use and over time. Retirement expense projections generated by this tool are calculated by Jackson using 2021-2022 Bureau of Labor Statistics (BLS) Consumer Expenditure Survey Micro Data4 and various measurements from the Bureau of Economic Analysis including the Regional Price Parity price index1 (RPP), the Consumer Price Index for the elderly2 (CPI-E), and the Personal Consumption Expenditures price index3 (PCEPI).

The calculation begins by converting current household income before taxes into national dollar values by using the selected current state's RPP1.

Next the income expressed in national dollar terms is leveraged by a proprietary analytical model based-upon BLS Consumer Expenditure Survey4 data to find category expense values.

Next the category expense values are updated to reflect elderly spending trends by multiplying each category's expense value by its corresponding CPI-E2 value.

Lastly each expense value is converted into the selected retirement state's dollars using a PCEPI3 ratio.

To calculate retirement expenses in future dollars, a weighted inflation factor is applied to each expense category, which is then compounded annually until retirement age.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company® (Home office: Lansing, MI), and Jackson National Life Insurance Company of New York®(Home office: Purchase, New York). Jackson National Life Distributors LLC, member FINRA.

Regional Price Parity Index (RPP)1

The RPP determines the inputted state’s purchasing power by weighing its average price level of goods and services against other states' averages.

Consumer Price Index for the Elderly (CPI-E)2

The CPI-E takes into account spending behaviors in households with a member age 62 or above. It represents an average value over a 40-year period from 1983 to 2022. 2022 was the last year data was collected.

Personal Consumption Expenditures price index (PCEPI)3

The PCE index tracks changes in price levels and consumer behaviors at the state and national level and is calculated annually.

Weighted Inflation Factor

The weighted inflation factor is calculated first by adjusting each subcategory inflation value based on the weight of the estimated subcategory expense value to the total category estimated expense value. The weighted inflation values are then averaged together to make a category weighted inflation factor. The subcategory inflation values are calculated by taking a 23-year average of the percentage change in prices as published by the Bureau of Labor Statistics Consumer Price Index for All Urban Consumers report4.

For cases where the average inflation rate over the 23-year period results in a value significantly higher than other categories, the period is extended to a 55-year period. In other cases where a negative inflation rate is returned, a general inflation rate of 2.49% is used. The general inflation rate is calculated by averaging yearly inflation rates, as published by BLS4 over a 23-year period.

The information displayed is for illustrative purposes only and will vary with each use. The outputs displayed are based on the estimated expenses and income you provided.

- * "U.S. States Fast Facts and Trivia." U.S. States Fast Facts and Trivia, Digital Properties, LLC, 20 July 1996, www.50states.com/facts/; Maura. “16 Facts About Washington DC You Never Knew Were True.” OnlyInYourState, 2016, www.onlyinyourstate.com/dc/fun-facts-washington-dc/.

- ^ “Your Retirement Benefit: How It’s Figured” Social Security Administration Publication No. 05-10070, January 2020; “Fast Facts & Figures About Social Security, 2019” SSA Publication No. 13-11785, August 2019; “Fact Sheet-Social Security” Social Security Administration 2020; “Number of Social Security Beneficiaries”, Social Security Administration 2020; www.ssa.gov

- "Regional Price Parities by State and Metro Area." U.S. Bureau of Economic Analysis (BEA), U.S. Bureau of Economic Analysis (BEA), December 14, 2023.

- "Consumer Price Index for the Elderly." U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, December 2022.

- "Personal Consumption Expenditures Price Index." U.S. Bureau of Economic Analysis (BEA), December 2023.

- "Archived Consumer Price Index Detailed Reports." U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 2022 Supplemental Files.

IMPORTANT: The outcomes displayed in the Proposed Gap Solution are hypothetical in nature, do not reflect an individual's actual investment results and are not a guarantee of future results. This tool is for illustrative purposes only and is not representative of the past or future performance of any Jackson product. Results may vary with each use and over time.

The outcomes presented by the Proposed Gap Solution are provided for informational purposes and are not intended as investment advice or a recommendation. Your clients’ individual circumstances may vary. Your clients should consider their individual situation, including time horizon, risk tolerance, investment objectives and the need for an annuity before investing.

The Proposed Gap Solution is designed to calculate the investment amount needed today to purchase a variable annuity with an add-on living benefit to cover the estimated Income Gap in the first year of retirement and continue that income payment through the lifetime of the retiree. This calculation is done independently by Hedgeness Inc. by using its data-driven and objective software called Guaranteed Retirement Analytics for Income and Legacy (GRAIL).

The withdrawal assumptions rate for this tool is age 65. The actual rate could be lower or higher depending on the age at the time of withdrawal.

Methodology:

GRAIL determines the number of years until start of retirement using the desired retirement age minus current age entered in the Retirement Expense & Income Calculator.

Using the number of years until start of retirement along with the inputs of:

- Retirement Expense & Income Calculator

- Current age

- Retirement age

- Current salary

- Current state

- Retirement state

- Monthly expenses

- Guaranteed income amounts

- Estimated Income Gap dollar amount

- Risk Profile / asset allocation (choose one)

- Conservative allocation of 25 % Stocks, 60% Bonds and 15% Cash

- Moderate allocation of 50% Stocks, 45% Bonds and 5% Cash

- Aggressive allocation of 80% Stocks and 20% Bonds

- Conservative allocation of 25 % Stocks, 60% Bonds and 15% Cash

- Assumptions of a variable annuity with an add-on living benefit

GRAIL runs multiple historical iterations to arrive at an array of possible Proposed Gap Solution numbers and then calculates an output based on the median. Changing any of the inputs will result in a different output.

By using historical returns based on Shiller data of stocks (S&P 500 Index), bonds (10 year US Treasury), and cash (1 year US Treasury) dating back to 1871, GRAIL analyses incorporate many variables ranging from different sequence of returns to different market volatility, and calculate the multi-faceted effects of the same on the assumed variable annuity and add-on living benefit features.

Since all analyses are based on historical performance and what-if scenarios, the possible statistical relevance remains at the level of estimates that might substantially differ from future results.

To emphasize the hypothetical nature of these analyses, GRAIL also provides a second Proposed Gap Solution investment amount that is based on 0% returns of stocks, bonds, and cash through all the iterations. In the context of what-if scenarios, you can view this as the “worst case” scenario, because this number represents the maximum investment amount needed to invest today to meet the estimated Income Gap.

Important Information about Hedgeness:

Hedgeness Inc. (the “Company”) produces ratings, research, and reports (collectively the “Analytics”). The Company uses proprietary software to conduct the Analytics, and this disclosure is applicable to the software and its configurations.

The information produced by the Analytics regarding the possibility of varying investment outcomes are hypothetical, do not reflect actual investment performance, and are not promises of future performance. The results may differ over time.

There is no implicit or explicit guarantee that an investment approach based on the Analytics will be effective. The results shown are for informational purposes only.

The Company does not provide any guarantee or accept any liability related to quality or accurateness of data used in the Analytics and does not promise that the results of the Analytics will not diverge from their specified methodologies. The Company does not provide any guarantee for Company errors, both in regard to data and calculations thereof.

The information in Analytics should not be construed as investment advice, or a recommendation by the Company regarding the use or appropriateness of the findings. Investors should consult their financial professional to assess their investment goals. Investing involves risk, including potential loss of principal.

The Company is a software company and not authorized to sell any security or investment advice.

All names of indices, insurance carriers, asset managers, and products used in the Analytics are the property of their respective owners, and not those of Hedgeness, Inc.

In summary, the Analytics do not constitute investment advice offered by the Company; are provided solely for informational purposes; do not constitute an offer to buy or sell a security; and are not warranted to be correct, complete or accurate.

Jackson and Hedgeness are separate entities.